-

Email : support@riceedu.org

Call Now : 9522223698 -

Donor Advice

Who Need Conatct Us?

All contributions are exempted under section 80-G of the Income Tax Act 1961. A receipt for your donation will be sent to your email or address, which you can use to claim income tax exemption. Your donation is used for the needy people, thank you very much for your donation and you can check your donation anytime for 2 years that in which work it has been used. For which you can check from the office through Donor id.

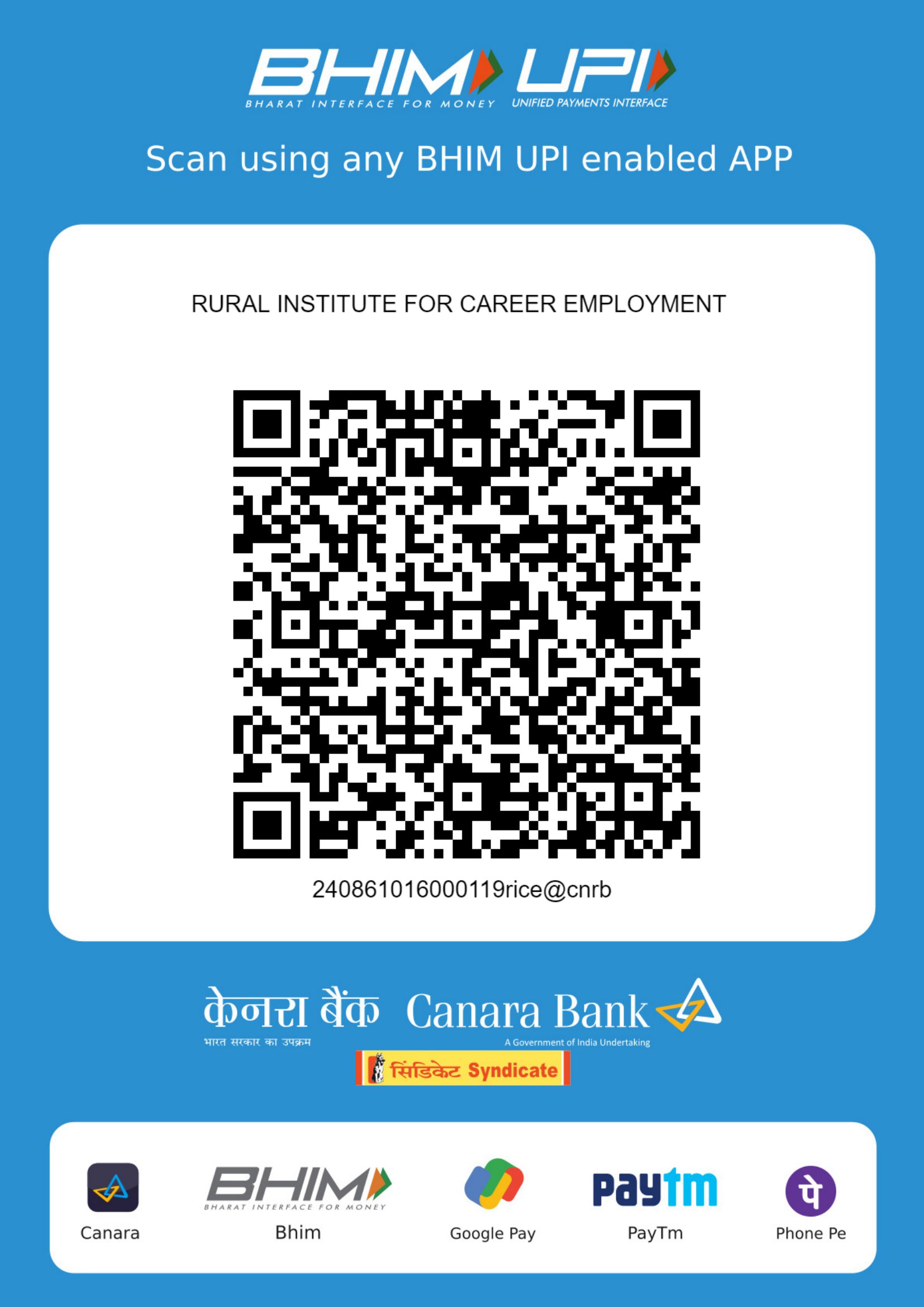

For Donate Direct Payment

Bank Name – Canara Bank

AC Holder Name – Rural Institute for Career and Employment Society

Account No. – 78501010000119

Ifsc Code – CNRB0003329

Swift Code - CNRBINBBBFD

Branch Address – Handi Chauk Raigarh 496001 Chhattisgarh

UPI ID : 240861016000119rice@cnrb

Online Donation

Donor Advice

Who Need Contact Us?

TRACK YOUR DONATION

The donation given by you is used in social work, so that the needy people can develop.

- Free school education only poor people need

- Plantation and their protection

- Learning for Work and Getting Employed

- Humanitarian Medical Services and Related Assistance

- Awareness and help of women empowerment

- Helping poor people to set up small employment

Donor Login

Donor List

HITESH KUMAR SAHU

ISHWAR PRASAD CHANDRA

SAPNA YADAV

ROSHNI BEHERA

ROHIT DANSENA

NARESH SAHU

Conclusion - A small contribution or donation made by you can change life for the poor, in whom our organization spends this amount in different areas, along with your donation, you get income tax exemption under the Income Tax Act. Yes, for the donation of at least 5000 rupees, you can get information about the work in which your amount has been used.